Why do we prefer options we know?

Ambiguity Effect

, explained.What is the Ambiguity Effect?

The ambiguity effect describes how we tend to avoid options that we consider to be ambiguous or missing information. We dislike uncertainty and are therefore more inclined to select an option where the probability of achieving a favorable outcome is known.

Where this bias occurs

Imagine that you’re in the midst of college course registration. You’re planning on taking one elective course and have a few options to consider. In order to better inform your decision, you decide to search online for reviews of the professors who will be teaching your top two picks. Suppose that one of the professors has an average rating, while the other has no ratings yet since this is their first semester teaching at your school.

In this scenario, most people tend to select the course taught by the professor with the average rating. Despite the fact that their reviews aren’t so great, we feel better knowing exactly what we’re getting ourselves into. We’re scared to risk taking a course with a professor who we know nothing about, on the off chance that they turn out to be a bad teacher. However, by playing it safe, we risk missing out on a phenomenal course taught by an excellent teacher. When making decisions like these, we often forget to give equal weight to the possibility that the result of taking a risk could actually be positive.

Debias Your Organization

Most of us work & live in environments that aren’t optimized for solid decision-making. We work with organizations of all kinds to identify sources of cognitive bias & develop tailored solutions.

Individual effects

The ambiguity effect can prevent us from giving two viable options equal consideration, resulting in suboptimal decisions. We may automatically decide against something based solely on the fact that we feel that putting our trust in the unknown is too risky. Succumbing to this cognitive bias prevents us from reaping the long-term benefits of riskier decisions.

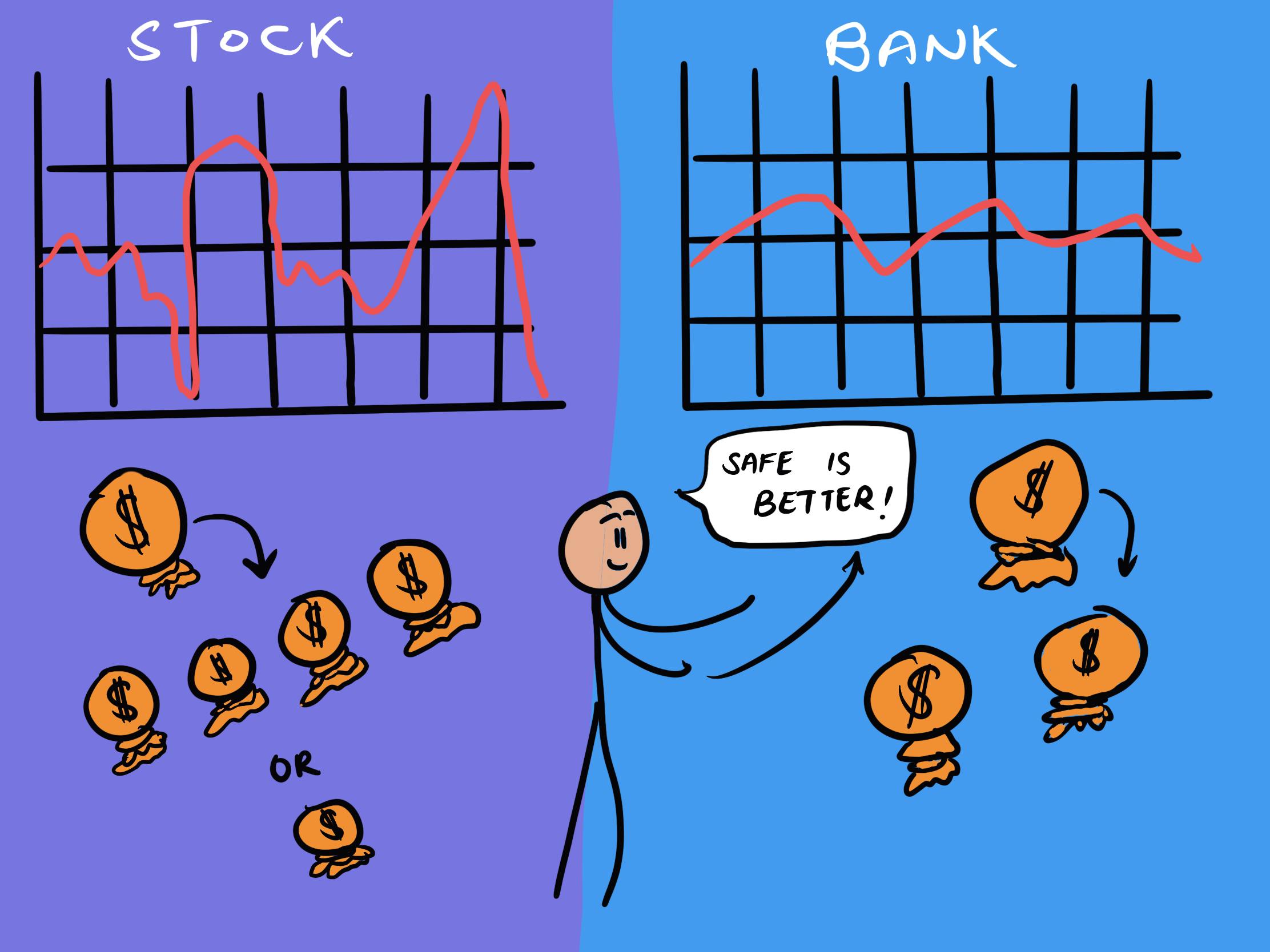

While the ambiguity effect is similar to the concept of risk aversion, the two biases are distinguished by how much information the decision-maker has. The ambiguity effect occurs when we know the probability of a certain outcome for only one of the available options. Meanwhile, risk aversion occurs when we know both probabilities yet still gravitate towards the option with a smaller payoff but greater likelihood of success. In both cases, our dislike of choosing options we consider to be risky can limit our ability to make the best decisions.

Systemic effects

The ambiguity effect can influence small choices made in our day-to-day lives, but it also impacts decision-making on a much larger scale. It can cause institutions, like schools, companies, and governments, to remain committed to failing systems, instead of introducing new policies or programs with the potential for improvement. This happens because even though these changes could better the system, things could still go astray and ultimately result in us being worse off than when we started. Even if the current system isn’t optimal, sticking with it feels safer than implementing change, because it is understood and its course is more predictable. Ignoring these calls to action by deciding against taking a risk can cost institutions—and the people they’re supposed to be benefiting—greatly.

How it affects product

Users often gravitate towards digital products with familiar interfaces and features, even if newer or less familiar products might offer better functionality or efficiency. This is because the ambiguity of learning a new system or adapting to unfamiliar features deters them from exploring potentially superior options. The same thing goes for when a digital product undergoes significant updates. Users may resist adopting the new version, hesitant about what the changes may bring.

The ambiguity effect and AI

People often hesitate to trust AI systems for critical decision-making, such as in healthcare diagnoses, legal advice, or financial planning. This is because the complexity and perceived unpredictability of AI algorithms create uncertainty about their reliability and effectiveness. Users tend to favor human judgment in these areas, perceiving it as more transparent and understandable. However, we may miss out on the opportunity to save time and resources, as well as make more accurate judgments, if we continue to write off AI as being too “ambiguous.”

Why it happens

As with other cognitive biases, there are several theories behind why the ambiguity effect occurs. One is that it is a “rule of thumb” useful for quick, effortless decision-making and problem-solving. Another is that higher levels of ambiguity aversion make people more likely to exhibit this bias.

Rule of thumb

It has been suggested that the ambiguity effect is the result of a heuristic used to facilitate decision-making. Like other heuristics, the ambiguity effect acts as a guideline for describing a general approach to problem-solving. This strategy occurs automatically and effortlessly, helping you to reach a conclusion quickly. Heuristics have endured for as long as they have because oftentimes, they are right. However, by using them, we risk drawing a conclusion that is inaccurate or misinformed because we fail to engage logic and reason.

To an extent, the ambiguity effect is an adaptive response. People prefer options that they feel well-informed about to options that they feel leave too much to the imagination. This can be useful for avoiding options for which we genuinely have too little information to go on. Even better, the ambiguity effect can lead us to seek out more information about the ambiguous option, so as to make a more informed decision.1

This rule of thumb does work on some occasions. That being said, over-reliance on this heuristic is not ideal. As explained by Frisch and Baron,2 the ambiguity effect is a type of framing effect, such that any option can be made to seem ambiguous or unambiguous, simply by drawing attention to or away from certain unknown elements of it. Essentially, one can never know everything about a given option. Believing that one does can simply be the result of “a lack of imagination about what information one could have." Thus, while using this heuristic certainly makes decision-making easier, it is not nearly reliable nor effective enough for it to be used in all situations. This is especially true when it comes to making decisions that carry a lot of weight.

Ambiguity aversion

Say you’re presented with two options. The probability of the first option resulting in a certain favorable outcome is known. In contrast, the probability of the second option resulting in said outcome is unknown. If you tend towards the former option, you’re exhibiting a behavior referred to as ambiguity aversion. It’s this distaste for ambiguity that drives the ambiguity effect.

Although they are similar, ambiguity aversion and risk aversion are two distinct behaviors.3 It’s important to differentiate between them to accurately grasp the concept of ambiguity aversion. Risk aversion occurs in situations where the probabilities of different options resulting in certain outcomes are known. In these cases, those who are more risk-averse will choose the option that results in a smaller payoff, because it has a greater probability of success than the option with the potential for a larger payoff.

In situations where ambiguity is minimal, men, in general, display more ambiguity aversion than women. However, as the situation becomes more ambiguous, this gender difference starts to disappear and men and women begin to exhibit similar levels of aversion.4

Unlike risk aversion, which is linked to several different traits, such as IQ and ambition level, ambiguity aversion is not predicted by any psychological measures.5

While this demonstrates that risk aversion and ambiguity aversion are two distinct parameters, it does not explain why ambiguity aversion occurs. The lack of correlation with ambiguity aversion significantly limits our understanding of the ambiguity effect.

Different people have different levels of ambiguity aversion. Those who are higher on this trait are more likely to display the ambiguity effect. Unfortunately, since we do not have a clear understanding of why some people exhibit more ambiguity aversion than others, we cannot provide a complete explanation as to why the ambiguity effect occurs.

Why it is important

As with any other cognitive bias where decision-making is compromised, it is important to understand what the ambiguity effect is and how it influences us. From there, we can work towards cultivating the ability to recognize when we’re engaging in this bias. This awareness will help us avoid this bias altogether, which will enable us to make well-informed decisions based on reason.

How to avoid it

To avoid limiting ourselves, we need to learn to override our initial impulse to avoid ambiguous options and situations. As with any heuristic, the first step to doing so is recognizing its existence and its influence over our decision-making.

A major part of avoiding the ambiguity effect is being willing to put the time into making decisions. Heuristics allow us to make decisions effortlessly and automatically. We’re faced with so much information and so many choices within a given day that this can be an efficient way to allocate our mental resources. However, certain decisions deserve more effort. The less ambiguous option may initially seem more desirable, but, as Frisch and Baron6 point out, you might actually know less about it than you think you do.

It can be helpful to reframe the situation. This may reveal that the less ambiguous option isn’t as superior as it seemed. Furthermore, when assessing the more ambiguous option, it’s important to focus not just on what can go wrong, but also on what can go right. When faced with ambiguity, we tend to imagine the worst-case scenario, forgetting that there’s an equal likelihood that the outcome could be the best-case scenario.

How it all started

The concept of the ambiguity effect was first developed by Daniel Ellsberg in 1961.7 While the term “ambiguity effect” was not coined in this paper, it laid the groundwork for the theory behind this cognitive bias.

In this paper, Ellsberg outlines a hypothetical experiment that has become one of the most common examples used to explain the ambiguity effect.

Imagine you are playing a carnival game where you can win $100 by drawing a ball of a certain color from a bucket. The bucket contains 90 balls, 30 of which are red. An unknown proportion of the remaining 60 balls are yellow, and the rest are black. You are told to choose whether you want to try to draw a red ball or a yellow ball. Drawing a ball of the color you bet on will win you the $100, while drawing a black ball or a ball of the color you did not bet on will get you nothing.

The majority of people state that they would rather bet on the red ball. What makes this interesting is that the odds of drawing a yellow ball are equal to the odds of drawing a red ball. The probability of drawing a red ball is ⅓, because 30 of the 90 balls are red. The probability of drawing a yellow ball is also ⅓, because the number of yellow balls is equally distributed between zero and 60. Thus, the reason people choose to bet on drawing a red ball has nothing to do with statistics. It has more to do with the fact that we prefer the known to the unknown.

Example 1 – Choosing a treatment plan

The ambiguity effect is often seen in medicine, on both the side of the patient and the side of the doctor.

From the doctor’s perspective, it is preferable to recommend a treatment that they are familiar with, rather than one that they don’t know much about or that is not typically used to treat this specific condition. The hesitation here is valid. The Hippocratic Oath clearly says “do no harm” and a doctor may feel that they are going against that by recommending a treatment when they are uncertain of the effects it might have.8 Yet, when conventional treatment is unsuccessful, going down the more ambiguous route may be the best way to help the patient.

On the patient’s side, the ambiguity effect typically occurs when their healthcare provider does not explain the recommended treatment well enough for it to be understood by a layperson. A lack of clarity prompts unease on the part of the patient, making them hesitant to follow through with the doctor’s treatment plan. They feel as though they are missing information, which can trigger ambiguity aversion. Thus, healthcare providers should explain all relevant treatments clearly and without the use of medical jargon.9

Ensuring that the patient understands the treatment being recommended to them makes the treatment option less ambiguous. This will encourage the patient to agree to this treatment which is in their best interest.

Example 2 – Making a sale

Anyone who works in sales should be aware of the ambiguity effect. The amount of information available to your customers can have a big influence on their decision to purchase one of your products.

Take a car dealership, for example. Suppose someone is attempting to choose between two similar vehicles, one at your dealership and one from another dealership. Should you be lacking certain information about your car that your competitor can provide about their car, you likely won’t make the sale. The customer would rather choose the car that they know more about because it feels like the safer move.

The ambiguity effect also comes into play with website design. If you run an online store but fail to provide information like duty fees and shipping times, potential clients may be deterred from buying from you. Instead, they might gravitate towards a website where they can purchase similar products but also have ready access to this information.

Summary

What it is

The ambiguity effect describes how our decision-making is influenced by how much information we have. Specifically, we have an aversion to options for which we feel are lacking information.

Why it happens

The ambiguity effect may be the result of a heuristic to avoid options for which we feel we don’t have sufficient information. Additionally, people with higher levels of ambiguity aversion are more likely to display this behavior.

Example 1 - Choosing a treatment plan

In medicine, both doctors and patients can exhibit the ambiguity effect. Doctors may hesitate to recommend a treatment that they are unfamiliar with even though it may be in the patient’s best interest. Patients, on the other hand, may be unwilling to receive treatment that they feel they lack information about, making it important for doctors to ensure that they explain their recommended treatment plan clearly and without using jargon.

Example 2 - Making a sale

Store owners can lose business due to the ambiguity effect. If customers find that certain information is not provided at your store, but is readily accessible at your competitor’s, they may choose to shop with your competitor to avoid ambiguous options.

How to avoid it

To avoid the ambiguity effect, we must take an effortful, active approach to decision-making. Instead of automatically choosing the less ambiguous option, we should identify what we don’t know about that option, as well as recognize the potential benefits of choosing the more ambiguous option.

Related resources

The EU Consumer Policy on the Digital Market: A Behavioral Economics View

This article applies a behavioral economics perspective to online shopping. Specifically, the author draws a connection between the problems faced by consumers within the EU and three principles of behavioral economics, one of which is the ambiguity effect.